Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

market analysis

【XM Forex】--Weekly Forex Forecast – USD/JPY, S&P 500 Index, NASDAQ 100 Index, KOSPI Composite Index, Nikkei 225 Index

Risk Warning:

The purpose of information release is to warn investors of risks and does not constitute any investment advice. The relevant data and information are from third parties and are for reference only. Investors are requested to verify before use and assume all risks.

Hello everyone, today XM Forex will bring you "【XM Forex】--Weekly Forex Forecast – USD/JPY, S&P 500 Index, NASDAQ 100 Index, KOSPI www.xmcnglobal.composite Index, Nikkei 225 Index". I hope it will be helpful to you! The original content is as follows:

Fundamental Analysis & Market Sentiment

I wrote on the 19th October that the best trades for the week would be:

None of these trades set up until Friday’s close, so there were no trades last week.

A summary of last week’s most important data:

Last week’s big event was Friday’s lower than expected US CPI (inflation) data, which effectively gave the Federal Reserve every reason to make a rate cut of 0.25% at its meeting this week, and again at its meeting in December. This pushed major US stock market indices to new all-time highs, most strongly in the tech-focused NASDAQ 100 Index.

We saw UK inflation data surprise analysts to the downside, which triggered a dip in the British Pound. However, inflation data released in Canada and New Zealand were higher than expected, suggesting there are still inflationary pressures alive and well in the global economy.

It was a relatively minor detail but the broadly better than expected PMI data in major economies probably added a little to the generally bullish mood in stocks.

US President Trump has begun a tour of Asia, which will conclude on Thursday in a meeting with Chinese leader Xi. This dovetails with the 1st November deadline on which President Trump’s new 100% tariff on Chinese imports will be take effect, unless he stops or amends it. It is widely expected that Trump and Xi will make a mutually beneficial deal on tariffs and rare earths export restrictions, and whether that is concluded well or not, we can expect some strong volatility is likely in markets at the end of the week. Trump’s meetings with leaders during the earlier part of the forthcoming week might also trigger movement in particular markets and currencies from day to day.

There will be four major central bank policy meetings over the www.xmcnglobal.coming week.

The US government shut down goes on but is having little effect.

Keep in mind that many countries have put their clocks back an hour over this weekend to switch away from summer time but North America has yet to move, so time zone differentials have changed by an hour between North America and elsewhere.

The Week Ahead: 27th– 31st October

The www.xmcnglobal.coming week will probably see more activity in the market, due to the Trump / Xi meeting, and the four major central banks which will be holding policy meetings this week. Two of the banks (The US Federal Reserve and the Bank of Canada) are expected to announce rate cuts of 0.25%.

This week’s most important data points, in order of likely importance, are:

Due to the ongoing government shutdown in the USA, US data may be postponed indefinitely.

Monthly Forecast October 2025

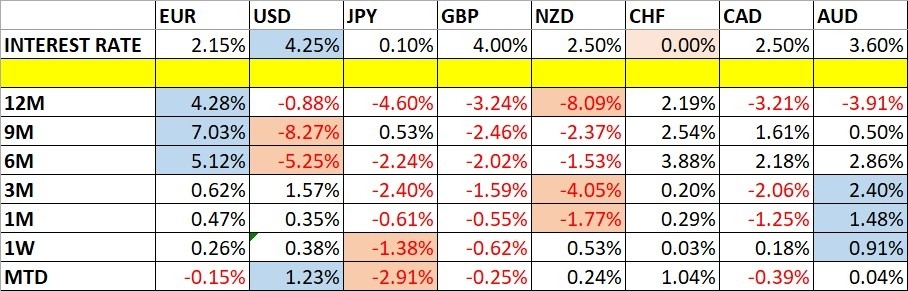

Currency Price Changes and Interest Rates

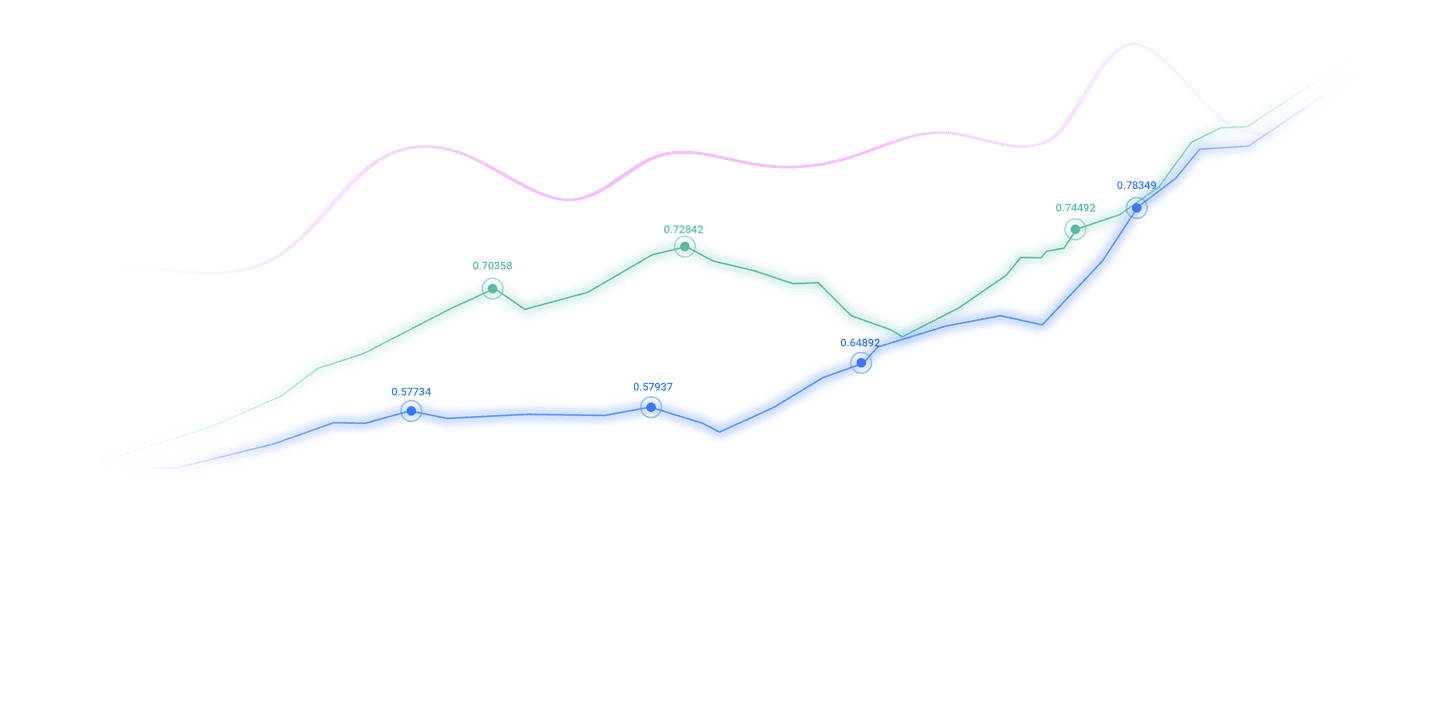

For the month of October 2025, I forecasted that the EUR/USD currency pair would rise in value. Its performance so far this month is shown in the table below.

October 2025 Monthly Forecast Performance to Date

Weekly Forecast 26th October 2025

I made no weekly forecast last week.

Although there were notably larger price movements in the Forex market last week, there were still no unusually large price movements in currency crosses, so I have no weekly forecast this week.

The Australian Dollar was the strongest major currency last week, while the Japanese Yen was the weakest. Directional volatility increased last week, with 37% of all major pairs and crosses changing in value by more than 1%.

Next week’s volatility is quite likely to increase.

You can trade these forecasts in a real or demo Forex brokerage account.

Technical Analysis

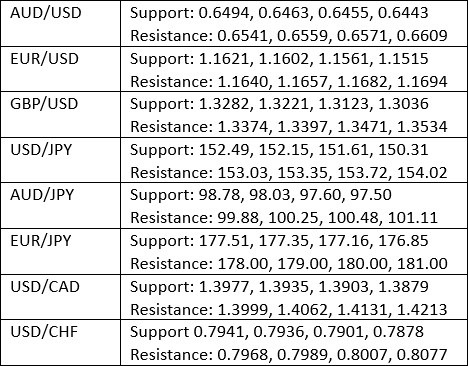

Key Support/Resistance Levels for Popular Pairs

Key Support and Resistance Levels

US Dollar Index

Last week, the US Dollar Index printed a bullish inside bar pattern with small wicks on both the upper and lower side. However, what is most significant here is the fact that the price has again failed to make a weekly close above the key resistance level at 98.60. If we do eventually get a breakout above this level by the US Dollar, we have already seen a real bottom put in so this could be the start of a major long-term upwards trend. Despite being just below its level of 26 weeks ago, the price is above where it was 13 weeks ago, so by my preferred metric, I can declare the long-term bearish trend is over. This places the US Dollar in an interesting position and very close to technically starting a new long-term bullish trend.

The Dollar may take a hit over the www.xmcnglobal.coming days if China does not back down over its proposed rare earth export restrictions in the face of President Trump’s 100% China tariff threat, but this situation is producing much more predictable movement in other currencies such as the Australian and New Zealand Dollars (heavily linked to the Chinese economy) and the Japanese Yen (the current haven currency of choice). The Canadian Dollar, as a proxy for Crude Oil, is also sensitive to perceived changes in risk-on demand. President Trump and President Xi will be meeting Thursday, and the tariff deadline is next weekend, so it should be an interesting and decisive week.

The Federal Reserve will be holding a policy meeting this week and is almost unanimously expected to cut its interest rate by 0.25%. That meeting will likely also trigger USD volatility.

I will be most www.xmcnglobal.comfortable being long of USD above 98.31 and even more so above 98.60.

US Dollar Index Weekly Price Chart

USD/JPY

The USD/JPY currency pair weekly chart printed a large, bullish candlestick with little upper wick which engulfed the real body and upper wick of the previous week’s range. These are bullish signs, and we are in a bullish long-term trend which was triggered by a recent breakout to a new 6-month high price, and such breakouts in this currency pair have historically tended to give traders a trend-following edge.

It should be noted on the bearish side, that the long-term price chart below shows that there is an important upper trend line in the dominant narrowing triangle pattern which has not even been tested yet. However, this probably will not happen until the price reaches the ¥155 area, so bullish action still has a meaningful way to run.

This is likely to be an important week for this currency pair, with the US Federal Reserve and the Bank of Japan both holding policy meetings, an incoming Japanese Prime Minister whose policies are sending the Yen lower, and a tariff showdown between President Trump and China’s President Xi scheduled for this Thursday.

If the developments of this week, especially Thursday’s meeting, are seen as good for the global economy and trade, we will probably see this pair rise significantly.

Like many trend traders, I am already long of this currency pair, but for a new long trade entry, I would like to see a daily (New York) close above ¥153.08.

USD/JPY Weekly Price Chart

S&P 500 Index

The Index started last week higher and showed a muted bullishness until Friday’s lower-than-expected CPI (inflation) data was released, which looks likely to put the Fed more firmly on a path of rate cuts, with two cuts in 2025 virtually assured.

Markets reacted to this by moving firmly though not excessively higher, with tech stocks leading the way, which caused this index to underperform the tech-based NASDAQ 100 Index but close at a new record high, very near the high, which was a short way above 6,800.

US stock market indices going to a new record high is one of the best bullish signs you can get, as is a rate cut and a trade deal, and both of those latter two are on the cards to happen later this week. These events could send this index even higher, so I think it makes sense to be long here already without any conditions.

If Thursday’s meeting between President Trump and President Xi does not lead to a satisfactory deal on rare earths export from China – which would be surprising – we would certainly see this Index fall strongly at the end of this week.

It is very easy to assume this trend is overstretched and cannot last. For traders, trying to pick the top of a stock market rally is very unlikely to be useful.

S&P 500 Index Weekly Price Chart

NASDAQ 100 Index

Everything I wrote above about the S&P 500 Index also applies to the NASDAQ 100 Index, but it is worth noting that the NASDAQ 100 outperformed the S&P 500 last week, and the price chart shown below is more bullish.

The tech-base index’s outperformance against the broader market suggests that markets believe China and the USA will make a deal about rare earth exports and tariffs.

I remain long here and think it makes sense to be long of this index without any conditions.

NASDAQ 100 Index Weekly Price Chart

KOSPI www.xmcnglobal.composite

The main South Korean equity index has put in a stunning performance this year, significantly surpassing even the traditionally dominant US market. The Index is up almost 70% since April, an astonishing advance, driven partly by the global tech boom and partly by legal reforms affecting corporate governance and the stock market.

The last two weekly candlesticks have been long, strong, and both closed very near their respective highs.

A new long trade is certainly likely to be late to the party, but maybe a quarter-sized long position using a trailing stop could be a sensible trade.

KOSPI www.xmcnglobal.composite Price Chart

Nikkei 225 Index

The main Japanese equity index the Nikkei 225 has put in a great performance this year, surpassing even the traditionally dominant US market. The Index is up by more than 60% since April, an astonishing advance, driven partly by the global bull market and partly by an increasing sense that Japan is really www.xmcnglobal.coming back economically after a long period of deflation.

A new long trade is certainly likely to be late to the party, but maybe a quarter-sized long position using a trailing stop could be a sensible trade.

Although the price closing at a record high is certainly a bullish sign, there are two things here bulls should watch out for:

For these reasons, I would only want to take a small long trade, and that only after we get a daily close above 50,000.

Nikkei 225 Index Price Chart

Bottom Line

I see the best trades this week as:

The above content is all about "【XM Forex】--Weekly Forex Forecast – USD/JPY, S&P 500 Index, NASDAQ 100 Index, KOSPI www.xmcnglobal.composite Index, Nikkei 225 Index", which is carefully www.xmcnglobal.compiled and edited by XM Forex editor. I hope it will be helpful for your trading! Thank you for your support!

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here

CATEGORIES

News

- 【XM Forex】--USD/SGD Analysis: Reactive Range as Outlooks Suffer Loud Agitation

- 【XM Decision Analysis】--Dax Forecast: DAX Continues to See Buyers

- 【XM Group】--GBP/USD Analysis: Selling Strategy May Strengthen in Coming Days

- 【XM Decision Analysis】--West Texas Intermediate Crude Oil Forecast: Continues Co

- 【XM Market Analysis】--GBP/USD Forex Signal: Overhead Pressure