Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

market analysis

【XM Market Review】--The Best Cheap Stocks to Buy Now

Risk Warning:

The purpose of information release is to warn investors of risks and does not constitute any investment advice. The relevant data and information are from third parties and are for reference only. Investors are requested to verify before use and assume all risks.

Hello everyone, today XM Forex will bring you "【XM Market Review】--The Best Cheap Stocks to Buy Now". I hope it will be helpful to you! The original content is as follows:

Equity markets continue to soar despite mild “stagflationary” pressures from a labor market that is much weaker than initially feared and inflation drifting in the wrong direction. Valuations for most stocks are excessive and do not reflect economic reality. Still, patient investors may find some interesting stocks among the best cheap stocks trading above $5 but below $10 per share. The bargain price carries heightened risk, and investors must understand what to look for before loading their portfolios with cheap stocks. Let’s take a look at the best cheap stocks to buy today!

What are Cheap Stocks?

While there is no exact definition of “cheap stocks,” as it depends on inpidual preferences, they typically refer to listed www.xmcnglobal.companies that trade between $5 and $10 per share. Cheap stocks are available in every sector and offer numerous opportunities to persify portfolios.

Why Should you Consider Investing in Cheap Stocks?

Cheap stocks an cprovide exciting growth opportunities for investors who are patient and know what to look for. They can also offer exposure to cutting-edge technology, medicine, AI, and other www.xmcnglobal.companies that have not yet achieved a breakthrough but are on the verge of disrupting their industries.

Here are a few things to consider when evaluating cheap stocks:

- Invest in cheap stocks with a proven management team that has a history of turning around www.xmcnglobal.companies.

- Research and understand the industry and how a cheap stock can make a notable impact with their product or service.

- Analyze the balance sheet carefully and dig through several quarters of financial reports to ensure the cheap stock is low on debt, has growing revenues, and plenty of cash reserves.

- Always keep a separate portfolio for cheap stocks.

What are the Downsides of Cheap Stocks?

Investors should understand that cheap stocks trade at bargain prices for a reason, and before they www.xmcnglobal.commit capital, they must know why the price is where it is. There could be financial issues, operational risks, going-concern warnings, legal troubles, and other problems that investors should be aware of. The risk is higher, and volatility remains elevated due to less liquidity.

Here is a shortlist of cheap stocks to consider:

- Mizuho Financial Group (MFG)

- Amprius Technologies (AMPX)

- Itaú Unibanco Holding (ITUB)

- Palladyne AI Corporation (PDYN)

- United Microelectronics Corporation (UMC)

- Turkcell Iletisim Hizmetleri (TKC)

- SNDL (SNDL)

- The Arena Group Holdings (AREN)

- CCC Intelligent Solutions Holdings (CCCS)

- Mercurity Fintech Holding (MFH)

Mizuho Financial Group Fundamental Analysis

Mizuho Financial Group (MFG) is a Japanese banking holding www.xmcnglobal.company and the parent www.xmcnglobal.company of Mizuho Bank, Mizuho Trust & Banking, Mizuho Securities, and Mizuho Capital. Upon its inception, it was the largest bank globally by assets, but today it is the third-largest Japanese mega bank. Mizuho Financial Group is also a www.xmcnglobal.component of the Nikkei 225 and the TOPIX Core 30.

So, why am I bullish on MFG despite its 25% rally this summer?

I appreciate the core business strength at Mizuho Financial Group. Its latest quarterly results showed a 30% growth in net interest income and 9% growth in fee income, which could spark buybacks and investments to continue outperforming peers. Valuations are low, and MFG continues to improve its profit margins. The healthy pidend is a bonus for holding its stock.

Metric

Value

Verdict

P/E Ratio

13.77

Bullish

P/B Ratio

1.15

Bullish

PEG Ratio

1.32

Bullish

Current Ratio

Unavailable

Bearish

Return on Assets

0.31%

Bearish

Return on Equity

8.48%

Bullish

Profit Margin

21.42%

Bullish

ROIC-WACC Ratio

Unavailable

Bearish

Dividend Yield

3.02%

Bullish

Mizuho Financial Group Fundamental Analysis Snapshot

The price-to-earnings (P/E) ratio of 13.77 makes MFG an inexpensive stock. By www.xmcnglobal.comparison, the P/E ratio for the S&P 500 is 29.45.

The average analyst price target for MFG is 6.75. It suggests limited upside potential, but fundamentals could catapult prices higher.

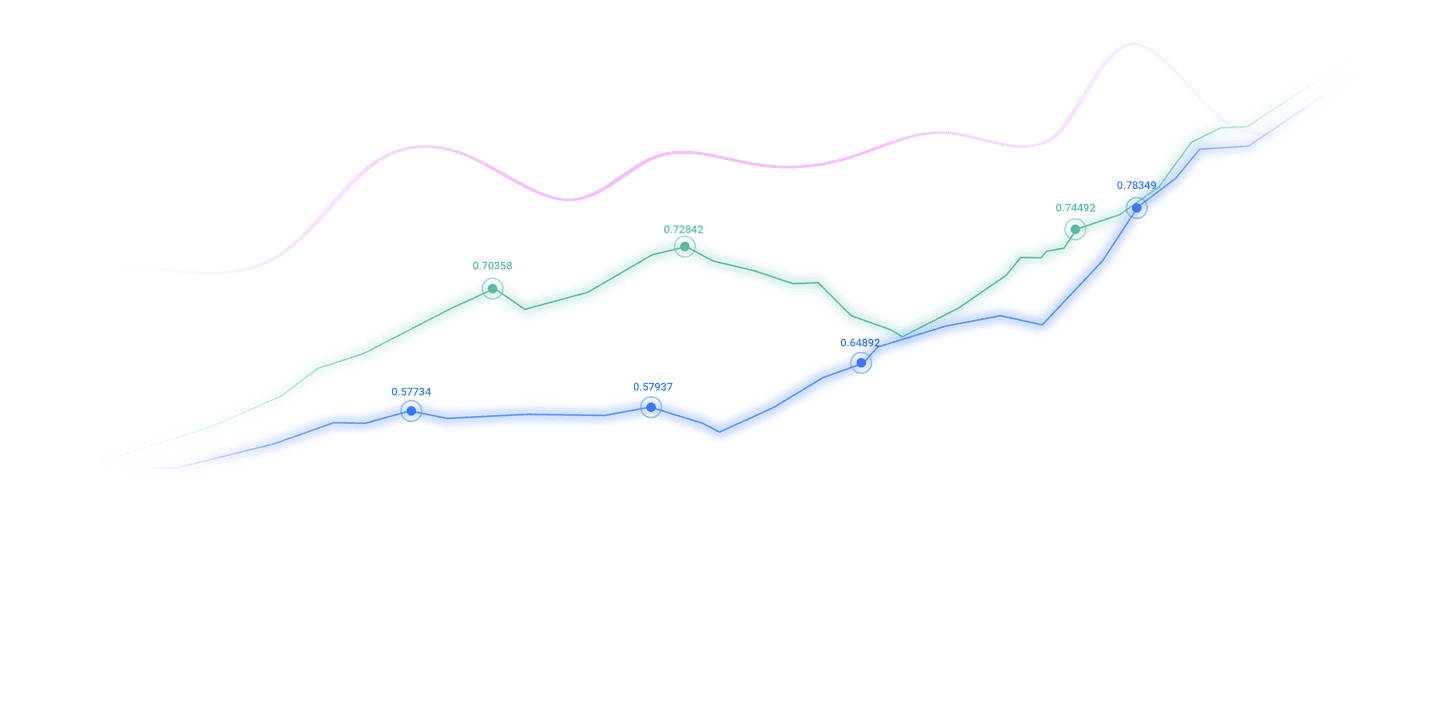

Mizuho Financial Group Technical Analysis

Mizuho Financial Group Price Chart

- The MFG D1 chart shows price action trading between its ascending 38.2% and 50.0% Fibonacci Retracement Fan levels.

- It also shows Mizuho Financial Group inside a bullish price channel with rising bullish trading volumes.

- The Bull Bear Power Indicator is bullish and has been so for almost two months.

My Call on Mizuho Financial Group

I am taking a long position in MFG between $6.48 and $6.75. I cannot rule out a short-term pullback, which I will take as an excellent buying opportunity. The price-to-book ratio limits downside potential, the PEG ratio suggests untapped potential, and the core business model is strong.

Turkcell Iletisim Hizmetleri Fundamental Analysis

Turkcell Iletisim Hizmetleri (TKC) is the leading mobile phone operator of Turkey, with the Turkey Wealth Fund as its largest shareholder (a 26.2% stake). TKS is one of the world’s largest www.xmcnglobal.companies and covers 100% of the population living in cities with over 3,000 residents across Turkey.

So, why am I bullish on Turkcell Iletisim Hizmetleri after its breakout?

Turkcell Iletisim Hizmetleri has low leverage and limited Forex exposure, shielding it against the negative impacts of the Turkish Lira. Pending price hikes for mobile and fiber optics could boost its excellent profit margins and return on assets. The pidend makes it an excellent long-term buy, and TKC trades below its book value, presenting a unique buying opportunity. TKS was also named among the best www.xmcnglobal.companies to work for by TIME.

Metric

Value

Verdict

P/E Ratio

15.94

Bullish

P/B Ratio

0.91

Bullish

PEG Ratio

0.15

Bullish

Current Ratio

1.73

Bearish

Return on Assets

6.36%

Bullish

Return on Equity

12.68%

Bullish

Profit Margin

12.40%

Bullish

ROIC-WACC Ratio

Negative

Bearish

Dividend Yield

4.02%

Bullish

Turkcell Iletisim Hizmetleri Fundamental Analysis Snapshot

The price-to-earnings (P/E) ratio of 15.94 makes TKC an inexpensive stock. By www.xmcnglobal.comparison, the P/E ratio for the S&P 500 is 29.45.

The average analyst price target for Turkcell Iletisim Hizmetleri is $7.87. It suggests excellent upside potential with limited downside risks.

Turkcell Iletisim Hizmetleri Technical Analysis

Turkcell Iletisim Hizmetleri Price Chart

- The TKC D1 chart shows price action between its descending 0.0% and 38.2% Fibonacci Retracement Fan.

- It also shows Turkcell Iletisim Hizmetleri breaking out above its horizontal support zone with surging bullish trading volumes.

- The Bull Bear Power Indicator is bearish, with an ascending trendline since the start of September.

My Call on Turkcell Iletisim Hizmetleri

I am taking a long position in Turkcell Iletisim Hizmetleri between $5.35 and $5.62. The price-to-book ratio, low valuations, and superb pidend yield make TKC one of the most appealing buys I have researched this year.

The above content is all about "【XM Market Review】--The Best Cheap Stocks to Buy Now", which is carefully www.xmcnglobal.compiled and edited by XM Forex editor. I hope it will be helpful for your trading! Thank you for your support!

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here

CATEGORIES

News

- 【XM Forex】--Gold Analysis: Retreats to $2,884

- 【XM Group】--USD/ZAR Forecast: Rand Faces USD Pressure

- 【XM Decision Analysis】--USD/JPY Analysis: Bullish Moves Ahead

- 【XM Market Analysis】--USD/MYR Analysis: Shifting Sentiment and a Speculative Ele

- 【XM Forex】--BTC/USD Forex Signal: Santa Claus Rally to Continue