Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

market news

【XM Group】--The Best Semiconductor Stocks to Buy Now

Risk Warning:

The purpose of information release is to warn investors of risks and does not constitute any investment advice. The relevant data and information are from third parties and are for reference only. Investors are requested to verify before use and assume all risks.

Hello everyone, today XM Forex will bring you "【XM Group】--The Best Semiconductor Stocks to Buy Now". I hope it will be helpful to you! The original content is as follows:

Semiconductor stocks refer to publicly listed www.xmcnglobal.companies that design and manufacture www.xmcnglobal.computer chips, also known as semiconductors. They are an essential www.xmcnglobal.component in today’s world, as they power everything from cars to consumer electronics, from telecommunication to energy, and from defense to artificial intelligence.

A semiconductor is a material with electrical conductivity to regulate electrical currents, embedded with tiny circuits. Without semiconductors, we would have www.xmcnglobal.computer chips with the most basic functions. The sophistication of semiconductors ranges from simple ones that power kitchen appliances to cutting-edge graphics processing units (GPUs) required by artificial intelligence (AI) and defense solutions.

Why Consider Buying Semiconductor Stocks?

Semiconductor stocks drive the global economy, and the integration of AI, www.xmcnglobal.combined with the recent boost in defense spending, will continue to fuel growth. Some investors www.xmcnglobal.compare semiconductor www.xmcnglobal.companies to the internet www.xmcnglobal.companies during the Dot-Com boom and bust, which have created today’s Magnificent Seven.

Here are a few things to consider when evaluating semiconductor stocks:

- Semiconductors are at the forefront of technological innovation, including AI and quantum www.xmcnglobal.computing.

- Investors must brace for volatility.

- Cyclical cycles will impact the share price of semiconductor stocks.

- The regulatory landscape is bound to change and adapt.

- Most semiconductor stocks have excessive valuations.

What are the Downsides of Semiconductor Stocks?

Many countries consider semiconductors as a national security item, as evident in the Sino-US geopolitical tensions. The industry also relies heavily on Taiwan, with a small but significant factor from the Netherlands. Therefore, supply chain disruptions can distort the investing landscape. High research and development costs and the difficulty and expense of fabrication plants create tremendous barriers for new entrants to disrupt the sector. Additionally, each significant R&D breakthrough can render previous chips obsolete.

Here is a shortlist of semiconductor stocks to consider:

- ASML (ASML)

- Qualcomm (QCOM)

- Texas Instruments (TXN)

- Credo Technology Group (CRDO)

- Rambus (RMBS)

- Taiwan Semiconductor Manufacturing (TSM)

- Applied Materials (AMAT)

- NXP Semiconductors (NXPI)

- Micron Technology (MU)

- Arm Holdings (ARM)

Update on My Previous Best Semiconductor Stocks to Buy Now

In our previous installment, I highlighted the upside potential of ASML and Qualcomm.

ASML (ASML) - A long position in ASML between $701.19 and $730.60

ASML rallied over 45%, and I closed my position at an even $1,000.00. It dropped below $1,000 before pushing higher once again, but I will not re-enter at current levels.

Qualcomm (QCOM) - A long position in QCOM between $20.15 and $20.97

QCOM advanced by over 15%, and my stop-loss triggered at $168.00, for a profit of over 13%. I will monitor price action for a new entry level.

Texas Instruments Fundamental Analysis

Texas Instruments ranks among the Top 10 semiconductor www.xmcnglobal.companies based on sales volume globally. Over 80% of its revenue www.xmcnglobal.comes from analog chips and embedded processors. It is also a member of the NASDAQ 100, the S&P 100, and the S&P 500 indices.

So, why am I bullish on TXN despite its 20%+ plunge?

While Texas Instruments was active in artificial intelligence in the 80s, I like this semiconductor www.xmcnglobal.company for its focus on analog chips, where it has few www.xmcnglobal.competitors, and a growing, stable customer base outside the AI hype. I am also optimistic about the fab investments, where TXN was early to recognize the need, and expect the recent leadership change to maintain the existing stability.

Metric

Value

Verdict

P/E Ratio

32.28

Bullish

P/B Ratio

10.11

Bearish

PEG Ratio

1.56

Bullish

Current Ratio

5.81

Bullish

Return on Assets

14.36%

Bullish

Return on Equity

30.57%

Bullish

Profit Margin

30.07%

Bullish

ROIC-WACC Ratio

Positive

Bullish

Dividend Yield

3.10%

Bullish

Texas Instruments Fundamental Analysis Snapshot

The price-to-earnings (P/E) ratio of 32.28 makes TXN an inexpensive stock. By www.xmcnglobal.comparison, the P/E ratio for the NASDAQ 100 Index is 38.08.

The average analyst price target for Texas Instruments is $202.85. It suggests good upside potential with manageable downside risks.

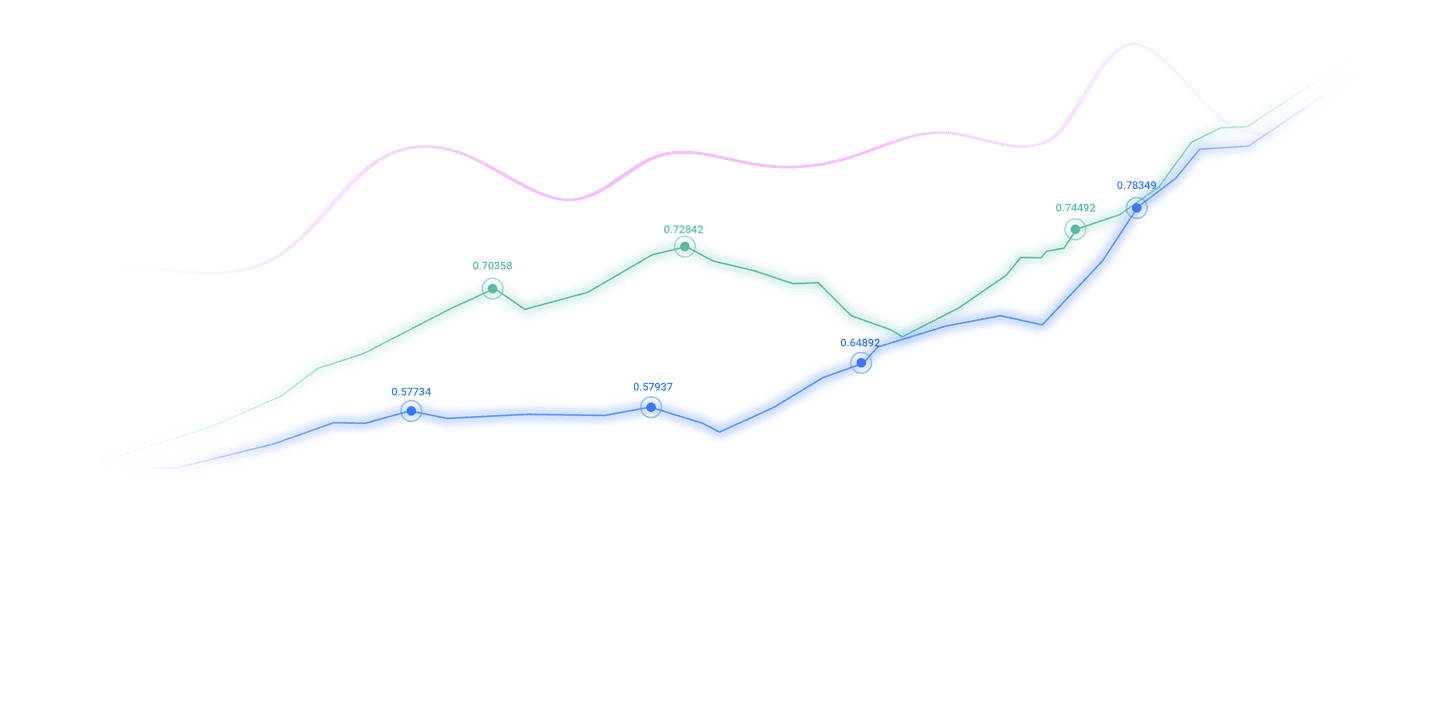

Texas Instruments Technical Analysis

Texas Instruments Price Chart

Texas Instruments Price Chart

- The TXN D1 chart shows price action below its ascending Fibonacci Retracement Fan.

- It also shows Texas Instruments inside a horizontal support zone with rising breakout pressures.

- The Bull Bear Power Indicator is bearish with a positive pergence.

My Call on Texas Instruments

I am taking a long position in TXN between $165.00 and $177.92. TXN ranks among the semiconductors with the healthiest balance sheet, boasts industry-leading performance metrics, with low valuation www.xmcnglobal.compared to its peers, and an excellent PEG ratio. It ranks as one of my top semiconductor picks right now.

NXP Semiconductors Fundamental Analysis

NXP Semiconductors is a semiconductor manufacturing and design www.xmcnglobal.company, the third-largest European semiconductor www.xmcnglobal.company by market capitalization, and the co-inventor of near field www.xmcnglobal.communication (NFC) technology. It is also a member of the NASDAQ 100 and the S&P 500 indices.

So, why am I bullish on NXPI following its breakdown?

NXP Semiconductors is another analog semiconductor play, and I am cautiously optimistic about its next earnings release. Valuations are low for a semiconductor stock, and NXPI has excellent profit margins, but its heavy exposure to the auto sector explains recent weakness in its share price. Unlike most of its peers, it stays out of the headlines and delivers steady, long-term growth and free cash flow, and management has indicated signs of a fresh upcycle.

Metric

Value

Verdict

P/E Ratio

25.58

Bullish

P/B Ratio

6.00

Bearish

PEG Ratio

1.13

Bullish

Current Ratio

1.74

Bearish

Return on Assets

8.51%

Bullish

Return on Equity

22.45%

Bullish

Profit Margin

17.72%

Bullish

ROIC-WACC Ratio

Positive

Bullish

Dividend Yield

1.87%

Bearish

NXP Semiconductors Fundamental Analysis Snapshot

The price-to-earnings (P/E) ratio of 25.58 makes NXPI an inexpensive stock. By www.xmcnglobal.comparison, the P/E ratio for the NASDAQ 100 index is 38.08.

The average analyst price target for NXP Semiconductors is $258.43. It suggests good upside potential with reasonable downside risks.

NXP Semiconductors Technical Analysis

NXP Semiconductors Price Chart

- The NXPI D1 chart shows price between its ascending 38.2% and 50.0% Fibonacci Retracement Fan levels.

- It also shows NXP Semiconductors breaking down below its horizontal resistance zone.

- The Bull Bear Power Indicator is bearish with an ascending trendline.

My Call on NXP Semiconductors

I am taking a long position in NXPI between $205.14 and $222.22. NXPI has a history of double-digit earnings-per-share growth, and I like the well-persified business model at current valuations. Short-term volatility could rise, which would provide a superior entry level.

The above content is all about "【XM Group】--The Best Semiconductor Stocks to Buy Now", which is carefully www.xmcnglobal.compiled and edited by XM Forex editor. I hope it will be helpful for your trading! Thank you for your support!

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here

CATEGORIES

News

- 【XM Forex】--GBP/USD Forex Signal: Potential Bullish Head & Shoulders Forming

- 【XM Market Analysis】--EUR/USD Analysis: Will the European Central Bank Change it

- 【XM Forex】--EUR/USD Forecast: Euro Gives Up Early Gains on Friday

- 【XM Market Review】--EUR/USD Analysis: Holds Near 1.05

- 【XM Group】--NASDAQ 100 Forecast: Continues to See Pressures - Are We About to Bo