Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

market news

【XM Group】--Bitcoin & Ethereum Volatility: Is the Fed the Only Hope for a Year-End Rally?

Risk Warning:

The purpose of information release is to warn investors of risks and does not constitute any investment advice. The relevant data and information are from third parties and are for reference only. Investors are requested to verify before use and assume all risks.

Hello everyone, today XM Forex will bring you "【XM Group】--Bitcoin & Ethereum Volatility: Is the Fed the Only Hope for a Year-End Rally?". I hope it will be helpful to you! The original content is as follows:

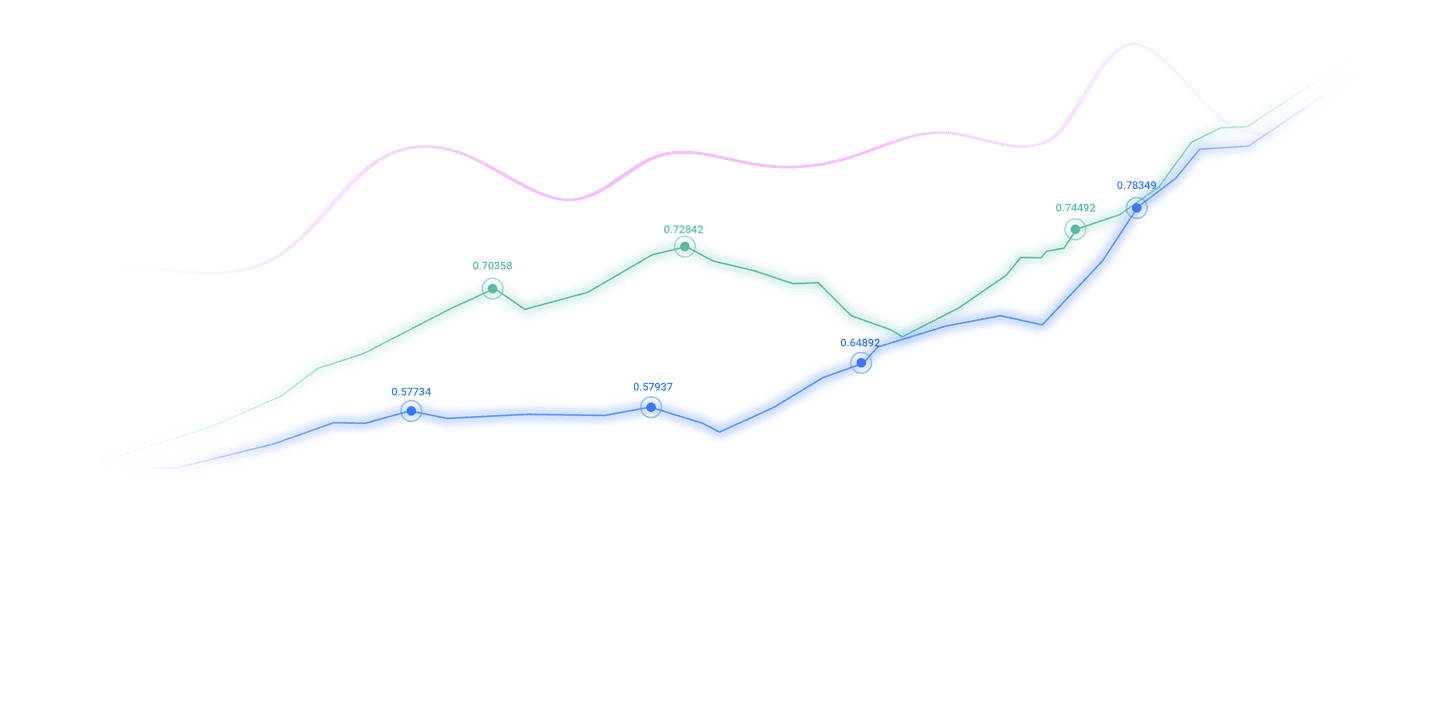

Tuesday saw Bitcoin (BTC) once again tease bullish hopes, with King Crypto surging to a high of $94,726, a 4.86% rally from the daily low, before pulling back to $92,768 at the close of the daily candle.

BTC/USD 1-day chart. Source: TradingView

While the price chart above shows a new pattern of higher highs and higher lows since late November, taking a step back shows that it still has a lot of ground to make up following its plunge from above $126,000 on October 6, when BTC set a new all-time high.

Bitcoin and the Federal Reserve

The main force driving speculation now is the Federal Reserve – specifically, Wednesday’s highly anticipated FOMC meeting at which Fed Chair Powell is expected to announce another rate cut. Markets are pricing in an 85–90% chance of a 25-basis-point rate cut, the third in 2025, which would bring the federal funds rate to 3.75–4%.

While retail waits with bated breath for a bullish announcement from the central bank, institutions have quietly been accumulating, preparing to finally enter the crypto game with weight trying to become as central to the digital asset market as they are with stocks.

Evidence for this can be seen in recent whale accumulations, with large holders absorbing 48,000 BTC in early December – equivalent to 240% of monthly issuance – signaling long-term conviction amid retail hesitation. Open interest in Bitcoin futures has climbed toward $30 billion, reflecting steady inflows from ETFs, which turned positive after outflows earlier in the quarter.

The recent price action has sparked intense debate within the ecosystem, with one side saying the 4-year cycle dictates that we are just in the beginning of a crypto winter, while the other side says the 4-year cycle is dead, and institutions have altered the trajectory.

Market analyst Ted Pillows represents the former, warning that BTC is mimicking its 2021 double-top performance and will soon have a bull-trap rally to $105,000 before heading lower.

$BTC seems to be mimicking the 2021 cycle. Similar double top structure and now a bounceback too. This means Bitcoin could rally towards the $100,000-$105,000 level before the next leg down. pic.twitter.com/3IiQf1bDbS

— Ted (@TedPillows) December 9, 2025X user Mike Investing is in the opposite camp and predicts Bitcoin will soon start its next wave higher, which will see it surpass $130,000 and further into uncharted territory as institutions begin to spread the crypto gospel.

$BTC has www.xmcnglobal.completed its full necessary pullback for the next wave higher. This time around $BTC will create the largest upward move it has ever seen beyond $130,000+ Many will be left behind continuing to remain bearish on $BTC. You’ll regret not taking advantage of this soon… pic.twitter.com/51opwKt1Tj

— Mike Investing (@MrMikeInvesting) December 9, 2025For now, the focus remains on the Fed, and despite what bulls and bears think, there are numerous factors that will shape how things play out in the months to www.xmcnglobal.come. At the time of writing, BTC trades at $92,568, a decrease of 0.85% on the 7-day chart.

Ethereum Upgrade Sparks Double-Digit Rally

While much of the focus for cryptos has been on Bitcoin, Ethereum has been a top performer over the past week, rallying from a low of $2,751 on December 1 to a high of $3,396 on Tuesday.

ETH/USD 1-week chart. Source: TradingView

Aside from the macroeconomic factors influencing the crypto market, the second-ranked crypto by market cap received a bullish boost from the Fusaka upgrade, which took effect on December 3.

Someone had to make the Fusaka cheat sheet. Here you go pic.twitter.com/C32z6Xiy9L

— James | Ethereum Foundation ⟠ | Snapcrackle.eth (@Snapcrackle) December 3, 2025Billed by some as a game-changer, the upgrade introduced (jargon warning) PeerDAS for 8x data blob capacity and Blob Parameter Only forks, which helped to scale throughput without decentralization risks.

In essence, the upgrade increased layer-1 capacity, enhanced layer-2 efficiency, slashed fees, and boosted rollup transactions. The increase in performance is particularly notable amid the rising use of stablecoins, which hit $6 trillion in volume in Q4 – surpassing the www.xmcnglobal.combined volume of Visa and Mastercard.

Other bullish factors for Ether include rising network activity, with active addresses up 10% week-over-week, and developer influx at 16,000 new contributors through September. The positive news, www.xmcnglobal.combined with a rate cut, has some analysts predicting its price could hit between $3,400–$3,900 by December's end, and $4,000+ in Q1 2026, though the recent volatility has many feeling shell-shocked and unsure of where things are headed.

Income Sharks has taken the middle path, noting that things are currently “looking good” for ETH, while also highlighting that it's advisable to remain cautious below $3,500, the level needed to confirm a “SuperTrend.”

$ETH - Still too early to say the bottom is in even though it's looking good. The last boss standing in the way until we can start officially celebrating is about the $3,500 level. You flip the remaining SuperTrend bullish and the bears start looking dumb again. pic.twitter.com/P3vOiVGQMs

— IncomeSharks (@IncomeSharks) December 9, 2025At the time of writing, Ether trades at $3,322, an increase of 8.05% on the 7-day chart.

The above content is all about "【XM Group】--Bitcoin & Ethereum Volatility: Is the Fed the Only Hope for a Year-End Rally?", which is carefully www.xmcnglobal.compiled and edited by XM Forex editor. I hope it will be helpful for your trading! Thank you for your support!

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here

CATEGORIES

News

- 【XM Forex】--ETH/USD Forex Signal: Facing Major Resistance Just Above

- 【XM Group】--USD/ILS Analysis: Speculative Wagers as Political Fireworks Threaten

- 【XM Decision Analysis】--USD/CHF Forecast: US Dollar Continues to Look for Buyers

- 【XM Group】--GBP/USD Analysis: Selling Strategy May Strengthen in Coming Days

- 【XM Market Review】--Crude Oil Monthly Forecast: February 2025