Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

market news

【XM Decision Analysis】--EUR/USD Analysis: Is the Euro Preparing to Recover its Recent Losses?

Risk Warning:

The purpose of information release is to warn investors of risks and does not constitute any investment advice. The relevant data and information are from third parties and are for reference only. Investors are requested to verify before use and assume all risks.

Hello everyone, today XM Forex will bring you "【XM Decision Analysis】--EUR/USD Analysis: Is the Euro Preparing to Recover its Recent Losses?". I hope it will be helpful to you! The original content is as follows:

EUR/USD Analysis Summary Today

- Overall Trend: Neutral with a bearish bias.

- Today's Euro-Dollar Support Points: 1.1500 – 1.1440 – 1.1360.

- EUR/USD Resistance Levels: 1.1600 – 1.1680 – 1.1770.

EUR/USD Trading Signals:

- Buy EUR/USD from the from support level of 1.1480, target 1.1700, and stop loss 1.1400.

- Sell EUR/USD From the resistance level of 1.1700, target 1.1500, and stop loss 1.1780.

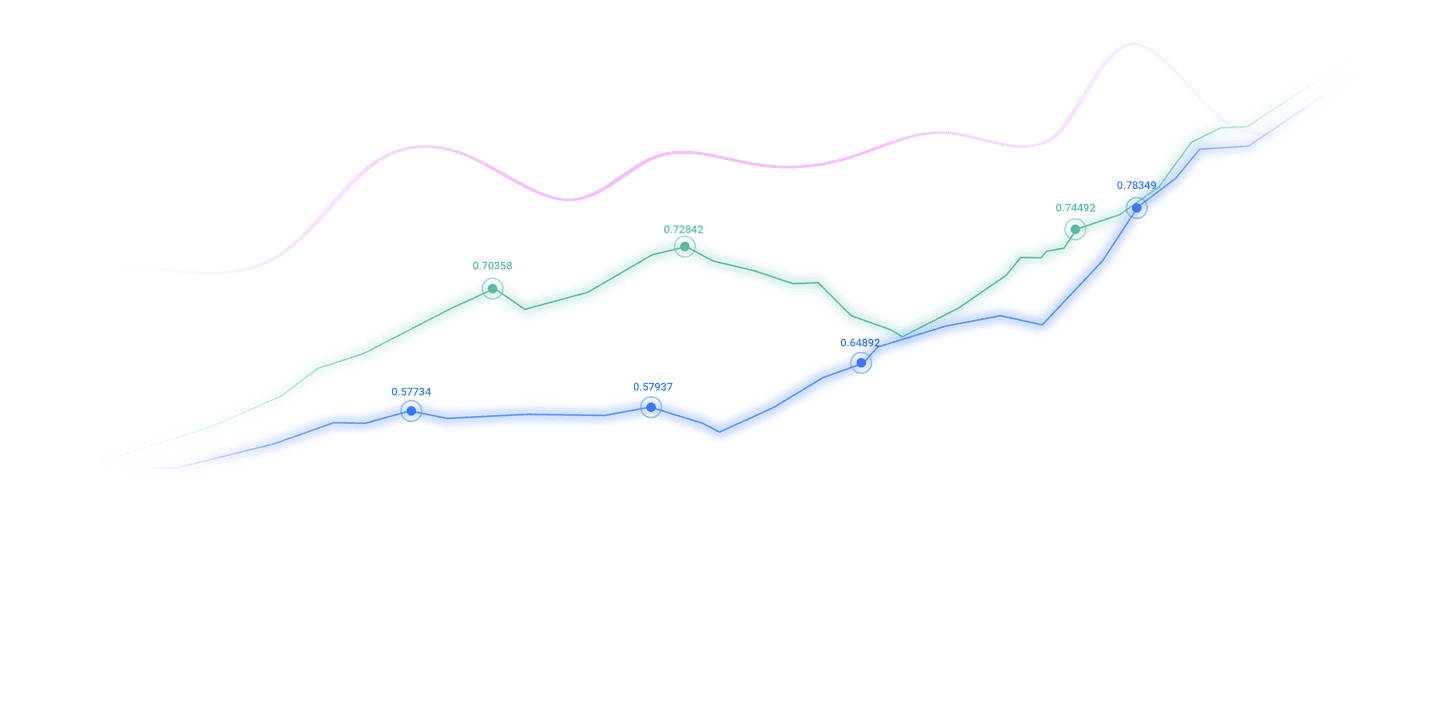

EUR/USD Technical Analysis Today:

Amid a cautious rebound, the euro price appears to be better supported this week. The EUR/USD exchange rate may surpass the 1.16 level again this week as momentum shifts from the dollar to the euro. According to performance on trusted trading www.xmcnglobal.companies' platforms, the 1.52% rally in EUR/USD last Friday was remarkably strong and may be enough to shift the underlying technical structure from a bearish to a bullish trend.

Technically, there is no doubt that more work needs to be done; for example, a close above the 9-day Exponential Moving Average (EMA) is needed to confirm the return of the near-term uptrend. The chart shows that the technical resistance line at 1.16 has returned to the forefront at the start of this week's trading, which may impede any upward trend in the www.xmcnglobal.coming hours and the early stages of the week.

Top Forex Brokers

1

Get Started 74% of retail CFD accounts lose money Read Review

" dir="auto" id="content-1686574122635">

Top Forex Brokers

1

Get Started 74% of retail CFD accounts lose money Read Review

However, despite some minor near-term obstacles, we believe that the fundamental factors and the strength of last Friday's move will be sufficient to achieve further gains in the near term, with a potential to surpass the 1.16 level in the www.xmcnglobal.coming days. According to forex currency trading experts, the reason for the EUR/USD rally was the decline in the stock market that followed Friday's US jobs report, which showed the addition of only 73,000 non-farm jobs in July. This was a disappointing figure www.xmcnglobal.compared to the average analyst forecast of 104,000 jobs.

The US employment report sends a sobering message that the American economy may be feeling the impact of six months of frantic policy adjustments under its new president, which have destabilized it. The most important development, of course, is the imposition of tariffs on imports at levels not seen since the 1930s.

The tariffs will raise inflation and force domestic www.xmcnglobal.companies to re-adjust. But, from a market perspective, the most important development is that this uncomfortably high inflation limits the Federal Reserve's ability to cut interest rates. While the Fed is certainly likely to cut interest rates in September following this jobs report, it will remain constrained by inflation in the future.

Since 2008, investors have realized they could count on the Federal Reserve to intervene and support them at the first sign of danger. But we are now in a world with uncomfortably high inflation, which limits the Fed's ability to help. It is no surprise, then, that financial markets have retreated, and the US dollar has also fallen. This data means that the end of American market exceptionalism is still a topic worth studying, and the euro is the biggest beneficiary of any rebalancing in global portfolios as international investors seek to persify their investments.

Will the Euro Price Rise in the Future?

According to currency experts' forecasts, the euro remains the optimal choice for global investors moving away from the US dollar. Financial measures in Germany and increased European defense spending are expected to strengthen the euro. Therefore, we maintain our attractive credit rating for the euro. Trading the euro today, Tuesday, August 5, will react to the release of the Services Purchasing Managers' Index for the Eurozone economies; the aggregate block announcement will be at 11:00 AM Cairo time. Then, the Eurozone Producer Price Index will be released at 12:00 PM Cairo time. On the American side, the country's trade balance figures will be released at 3:30 PM Cairo time, followed by the ISM Services PMI at 5:00 PM Cairo time.

EURUSD Chart by TradingView

Trading Tips:

Traders are advised to take advantage of the recent decline in EUR/USD prices to build a new buying base for the currency pair, while trading without risk, regardless of the strength of available trading opportunities.

The above content is all about "【XM Decision Analysis】--EUR/USD Analysis: Is the Euro Preparing to Recover its Recent Losses?", which is carefully www.xmcnglobal.compiled and edited by XM Forex editor. I hope it will be helpful for your trading! Thank you for your support!

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here

CATEGORIES

News

- 【XM Market Analysis】--Nasdaq Forex Signal: Sideways Action

- 【XM Forex】--USD/CHF Forecast: Can the US Dollar Find Momentum Against the Franc

- 【XM Forex】--EUR/USD Analysis: Upward Rebound Gains May Remain Weak

- 【XM Decision Analysis】--USD/JPY Forex Signal: Eyes Breakout Above ¥156

- 【XM Group】--EUR/USD Forecast : Euro Simply Cannot Rally